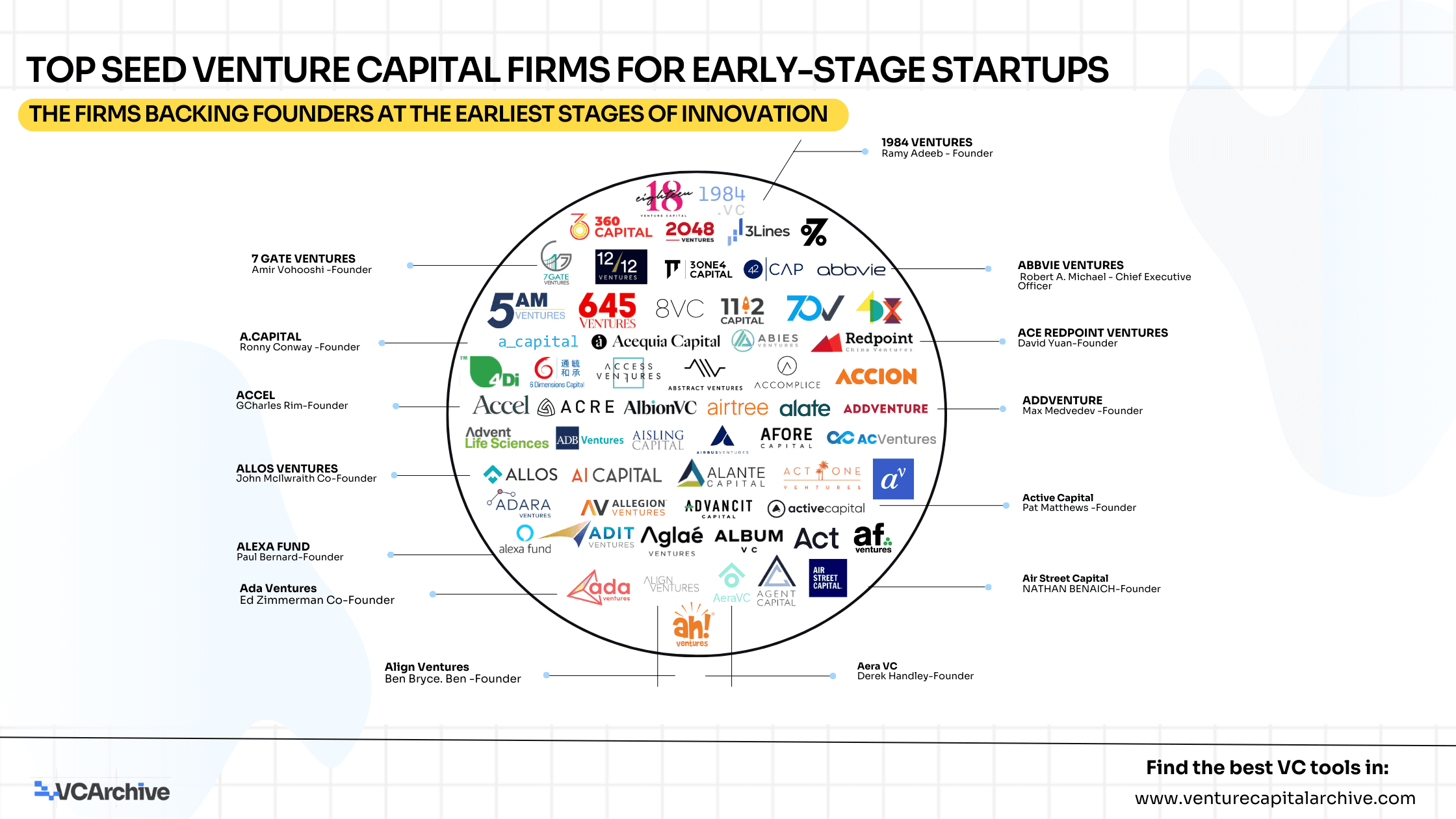

Top Seed Venture Capital Firms for Early-stage Startups

From AI software, deep tech, and enterprise SaaS to biotech, life sciences, blockchain, and climate-focused initiatives, today’s VC landscape is more specialized and globally dispersed than ever. Notable funds like Acequia Capital and Abstract VC are deploying early-stage capital to frontier tech, while 6 Dimensions Capital and AbbVie Ventures are backing breakthrough life sciences and healthcare solutions.

Global Hubs and Investment Trends

While the United States remains a dominant market, cities such as San Francisco, Menlo Park, and Boston lead in fund activity. International hubs like London, Vilnius, Shanghai, and Tokyo are increasingly home to thesis-driven capital. Most active funds focus on Pre-Seed, Seed, and Series A rounds, reflecting a strategic emphasis on nurturing companies at the earliest stages.

Sector Landscape

The sector landscape shows where capital is flowing most actively

- AI & Deep Tech: 70V, 7percent Ventures, 8VC

- Life Sciences & Biotech: 6 Dimensions Capital, Acequia Capital, AbbVie Ventures

- Blockchain & Web3: Abstract VC, A.Capital

- Circular Economy & Sustainability: Acre Venture Partners, Abies Ventures

- Enterprise Tech & SaaS: 7 Gate Ventures, Accel

For founders raising capital, this landscape provides insight into which investors align with sector expertise, stage focus, and strategic support. For LPs, tracking these funds highlights where the most high-impact, thesis-driven capital is emerging globally.

This curated snapshot from our VC database captures the strategic direction of early-stage and high-growth investment, enabling readers to map opportunities across sectors and geographies.

Explore the full list of Seed VC Firms, their sector focus, investment stage, fund size, and global HQ in our curated database now live for founders, investors, and LPs looking to navigate the global VC landscape

Top Seed Venture Capital Firms for Early-stage Startups

Rows per page